Nvidia’s share price then dipped to a split-adjusted $5 price, before bottoming out in January 2009. After adjusting for additional splits, the stock price of Nvidia returned to $36, before the 2008 subprime mortgage crisis. This was nothing compared to the 59% overall decline for the NASDAQ stock index.īy March 2002, Nvidia’s stock price was up 31% from the dot-com bubble peak, whereas the NASDAQ index was still down 61%. When the bubble burst in March 2000, Nvidia held up quite well, only dropping 15% in the year following. By February 2000, Nvidia’s stock price per share had already hit $117 per share. Nvidia went public on January 22, 1999, at the height of the dot-com bubble at $12 a share. Nvidia Stock Price Historical Trends 1999 to 2009

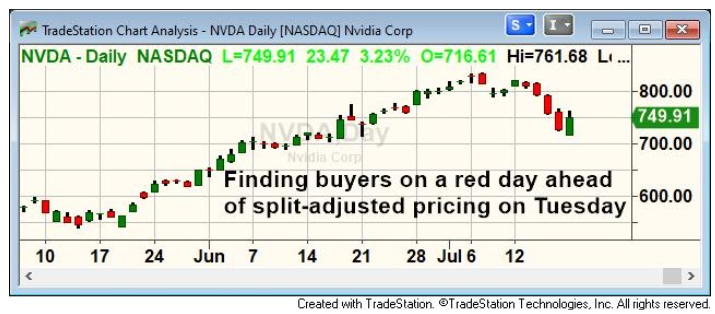

The average analyst price target is $685.43, which implies 14.3% upside potential to current levels.Let’s look at Nvidia stock price history, to get a clear picture of NVDA growth over the years. Nvidia’s shares have gained 72% over the past year, while the stock still scores a Strong Buy consensus rating based on 24 Buys and 2 Holds.

We see several structural tailwinds driving sustained outsized top-line growth: gaming, data center/ AI accelerators, and autonomous vehicles.” Through its Mellanox acquisition, NVDA expanded its DC footprint from AI-accelerators to providing highspeed networking interconnects. Today, its parallel processing capabilities, supported by thousands of computing cores are essential for deep learning AI algorithms in data centers. The GPU was initially used to create graphics for video games and film. Schafer said, “Nvidia has transformed from a graphics company to becoming a premier leading AI computing platform company.

In its most recent Q4 earnings report, the company reported full-year 2021 revenue and earnings of $16.68 billion and $10 per share, up 53% and 73% year-over-year respectively.Īnticipating a robust performance in the upcoming Q1 report, Oppenheimer analyst Rick Schafer maintained a Buy rating on the stock with a price target of $700, which implies 16.7% upside potential to current levels.

0 kommentar(er)

0 kommentar(er)